Our rebranding and digital campaign helped MaineHousing Open the Door to the Future for thousands of first-time homebuyers.

The Situation

For several years after the 2008 housing market retrenchment, demand remained weak for MaineHousing’s First Home Loans (FHL, a mortgage available only to first-time or “returning” homebuyers who meet income and purchase-price criteria, as well as military). MaineHousing faced three key challenges to rebuilding its loan portfolio:

- Apprehension about home ownership among its key audience, Millennials;

- The small rate gap between FHLs and market-rate loans; and

- Lack of strong interest among many lenders in making First Home Loans.

Our Strategy

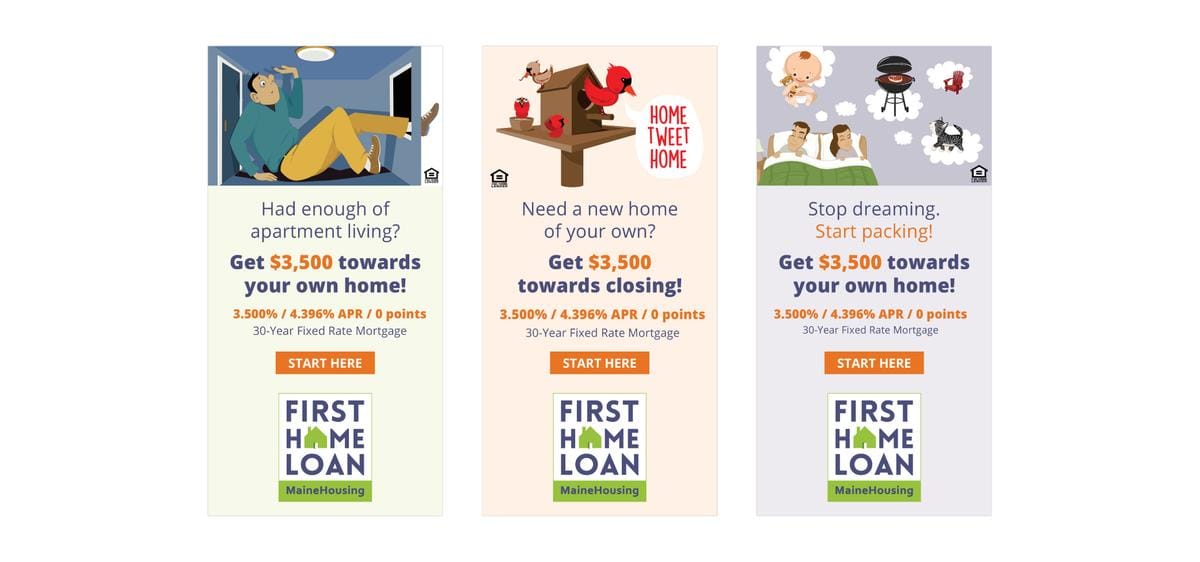

In 2015, we strengthened the program’s brand identity (logo, tagline, look and feel) to look more contemporary and less like a government program. We also redesigned and rewrote the FHL section of the MaineHousing website to make it more appealing visually and emotionally, and to focus more clearly on the benefits of home ownership, and FHL’s below-market rates.

We then created digital banner ad campaigns that appealed strongly to first-time homebuyers, as well as military audiences. We also used social media (especially Facebook) and Google Ads to drive prospects to the website.

To build support among lenders, we created the “Green Key Lender” designation for the banks, credit unions and mortgage companies that have earned the label.

Results

Our Google Ads performed five times, and our digital ads six times above industry norms. In the campaign’s first year, mortgage closings met MaineHousing’s very aggressive goal of 750 loans, a 50% increase over the previous year. In Year Two, the campaign helped to generate 980 loans, an additional increase of nearly one-third. Dollar volumes increased proportionately.